The COVID–19 global pandemic has shaken business and economies across the world, with many employees feeling a low morale during this time after being furloughed, made to work from home and consequently stripped of some of the benefits their employers previously offered in the workplace.

Employee benefits are incentives which reward employees for their work, ranging from free lunches to income protection. During the pandemic, it has become evident that it is not feasible to carry out most non-monetary benefits from home, according to a survey of UK SME workforce employees. Subsequently, a high majority of employees now desire more permanent benefits, the main one being income protection post-COVID-19.

Here we discuss the findings of this UK survey carried out by Hooray Health and Protection, in order to explain how employees feel about current benefits, how employee morale has been affected by the pandemic, and why Income Protection is the most desired benefit post-COVID 19.

COVID–19 has caused an economic downfall which is likely to mirror the recession of 2008. As a result, businesses have had to look at reassessing the future and what they can do to improve employee morale whilst staying afloat themselves. Due to this, Hooray Health and Protection carried out a survey on UK workers between June and July 2020, in order to assess whether employees are currently happy with their jobs, and what they expect for the future after experiencing lockdown.

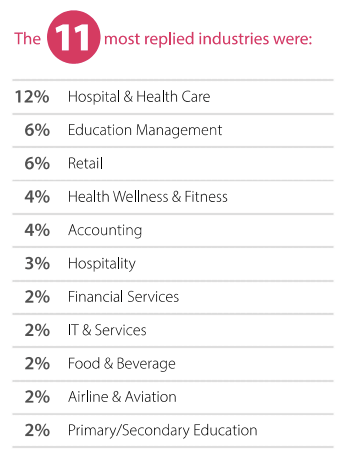

Analysing the 1150 survey responses from over 112 industries, including insight from industry-leading firms Yulife Insurance, Hays Recruitment and HR Solutions, Hooray found that 50% of employees are likely to be looking for a new job post-COVID-19. Therefore, employers are naturally asking what steps they can take to boost employee morale and one way to do so was to reassess employee benefits, to see how they are actually valued by staff.

Employee benefits usually lead to positive gain from both the employer and employees. For those employers looking to recruit more staff in the post-COVID-19 environment, benefits can be a selling point which attracts the best talent to the job. This can also mean the same level of talent post-pandemic will be retained.

Usual benefits commonly include, cycle to work schemes, having birthdays off, free lunches and team outings. With some workplaces offering more, such as health insurance and mental health support.

Benefits can also have a positive impact, as a morale boost is likely to also increase employee productivity and retention. Most importantly for the employee, it makes them feel appreciated and that they are not just an output producer for the company, especially if the benefits fit in well with their outside lives. For example, parents may appreciate flexible and remote working more than non-monetary benefits such as free workplace drinks.

However, the survey found that employee benefits are not a staple in every business. Additionally, with COVID 19 forcing people to work from home not all benefits have continued.

The survey results which contain respondents from across the UK, with 86% from England, 12% Scotland, 2% Wales and 1% Northern Ireland found that over half of employees are not currently happy with their benefits.

• 47% of employers currently offer no employee benefits to their staff.

• 31% of participants are happy with their employer’s current employee benefit offering. 55% of people are just okay, whilst 14% are not happy at all.

• Non-monetary perks are the most offered benefit with 16% of respondents receiving them this is closely followed by health insurance with 11% receiving it as a benefit.

Although the survey reveals that non-monetary perks are currently the most common employee benefits, they are less desired following lockdown with 10% less of the respondents wanting this as an additional benefit.

Interestingly, almost a quarter of employees (24%) want income protection, which is currently the least common benefit with only 6% currently receiving it.

Health insurance is desired by 22% of respondents which is twice the amount of than those receiving it. 16% of employees want life insurance, whilst nearly 75% of respondents believe flexible working will have some impact on morale as lockdown restrictions relax. Half of the respondents are likely to start looking for a new job post-COVID-19.

44% of respondents who are not satisfied with their current benefits said that having income protection, life insurance and health insurance would have a very high impact on their morale within the company.

This could explain why accountants were the happiest, as most already have income protection and life insurance as a perk of their job.

In contrast, the education management, retail, hospitality and healthcare sectors were the least satisfied with their benefits, which is no surprise as healthcare employees have the least benefits with 64% of frontline workers without any. After working long hours every day and working through particularly hard and risky conditions during the pandemic it is no wonder that most are unsatisfied.

The difference between what employees truly want and what they are currently receiving explains why only 31% of the total UK employees surveyed are pleased with the benefits they offered.

It is most likely that COVID 19 has also changed the priorities of employees. Non-monetary benefits have barely continued during lockdown, whilst income protection, insurance programs, mental health support and one-to-one development programs can easily continue during further lockdown if there were to be a second wave. Therefore, meaning that employees will still gain extra benefits which are more long term whilst remote working.

Leading on from this, the future is uncertain, and during the lockdown, people have learnt the importance of safeguarding their future and finances for themselves and their family, hence why short term non-monetary benefits have lost their value. Income protection ensures employees will still be paid in the likely event (in this current climate) that they may fall ill or if they are incapacitated to work. Meanwhile, people have spent extended amounts of time with their family, so it is no surprise that flexible working is also heavily desired by employees.

Hospitality, retail and aviation have all been hit particularly hard by the pandemic, so it is also evident why half of the respondents are looking for a new job. There’s too much uncertainty in many industries, so employees want change.

As recruitment begins to pick up, it is evident that businesses will need to consider their employee value proposition (EVP). This is a unique set of benefits that an employee receives in return for their skills capabilities and experiences. Defining EPV will be a selling point for a business and will ensure that employees remain happy and motivated.

Charlie Cousins, Founder of Hooray Health & Protection has said: “The COVID-19 crisis has been devastating for the job market and the true extent of the aftermath is still yet to be revealed. However, the biggest impact has been the human one with people fearing for their livelihoods.

“As businesses work to find their feet in this new normal, their employees need to be at the heart of their approach if they are to survive. Health insurance, which historically has been referenced as the most desired employee benefit has been overridden by income protection as employees grapple with the economic impact of COVID-19.

“50% of staff in the UK are already considering seeking new employment, therefore businesses must adapt quickly and significantly to ensure that their workforce is receiving the support they need.”