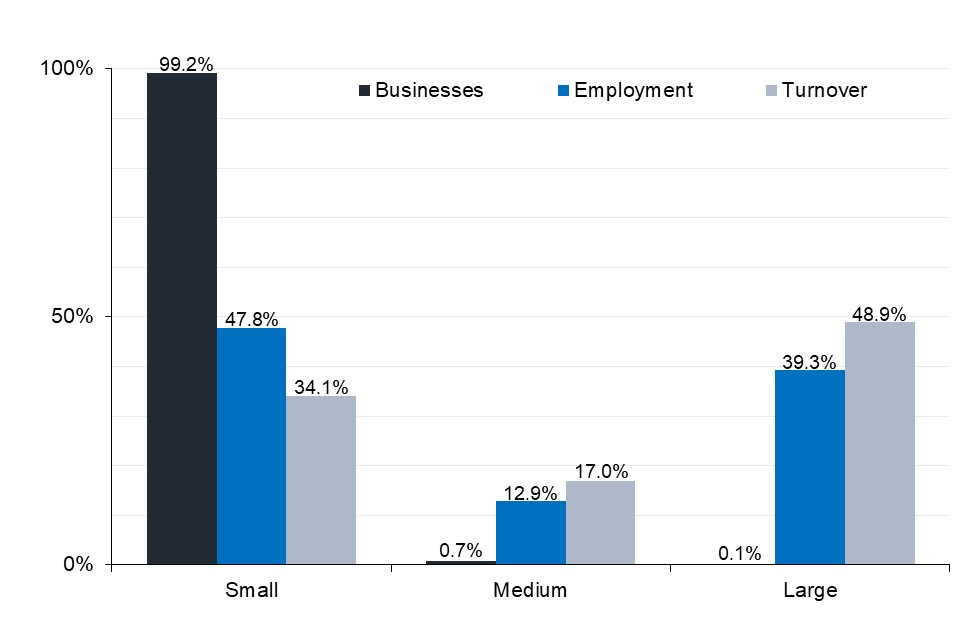

There are over 5.5 million SMEs in the UK, accounting for 99.9% of all British private sector businesses. The majority of these are small businesses (under 50 employees) and the remaining have between 50 and 249 employees.

While many people dream of running their own business, they face a lot of challenges to be successful. With many new businesses failing in just a matter of months, having a good idea is sometimes not enough. Oftentimes, building a partnership with another business can make all the difference.

How does a small business seek strategic partnerships that can enhance its efficiency and improve its chances for both survival and long-term profitability? Keep reading to find out.

What is a small business?

Generally speaking, business types can fall into three categories:

- Micro business: less than 10 employees with a turnover of less than £2 million.

- Small business: less than 50 employees with a turnover of less than £10 million.

- Medium business: less than 250 employees with a turnover under £50 million.

Of course, things could get confusing when a business is lucky enough to overlap those definitions. What would you call a business with eight employees but a turnover of £36 million? Rather than putting a precise name on such a business, you’d simply group it under the term ‘SME’.

Partnership types

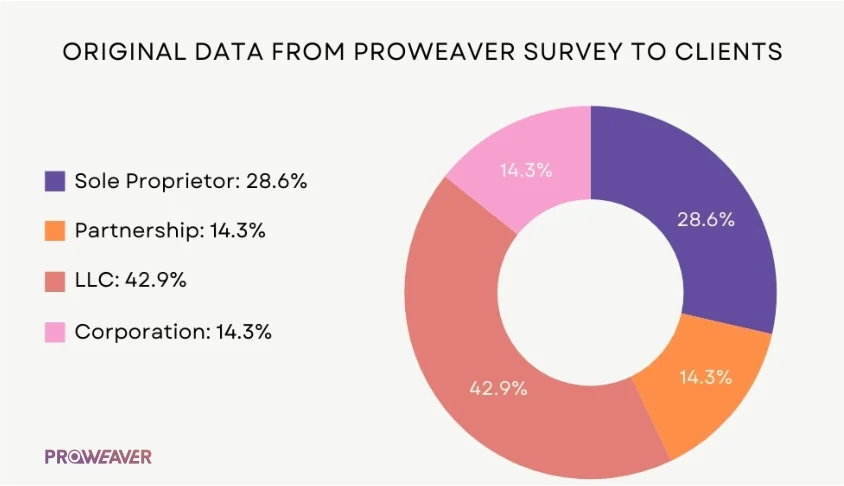

You have a good idea, you have some capital put aside (or seek a loan), and you decide it’s time to take the plunge and become an entrepreneur. At this stage, you have two main choices. Do you go it alone as a sole proprietorship or do you seek out partnerships that can help you with exposure and business growth? There are several types of partnerships that you can consider.

In the UK, a partnership is defined as when two or more people come together to form and operate a profit-oriented business. It must be run on a commercial basis and must be focussed around some sort of trade, profession, or occupation. The UK has three distinct types of partnership, each defined and governed by its own act of parliament.

However, you can also operate as a sole trader. This latter choice does not preclude you from seeking strategic partnerships with other businesses that can enhance your business and increase revenue.

1. Sole trader

This is the most common type of small business with over 3.1 million in the UK. Starting a sole trader business is quick and relatively easy. You generally require less startup capital and there are also far less paperwork and other administrative responsibilities than you would have with other business types.

The big drawback of being a sole trader is that you have personal responsibility for all business debts and, if things go horribly wrong, then you could face losing some or all of your personal assets. If your business made good money, you could also find yourself in a higher tax bracket than other business structures with the same revenue levels.

2. Partnership

You can also choose to enter into a partnership with one or more people. Your partner could also be another entity such as a limited company. Partners will share all aspects of the business including ownership, liabilities/debts, and profits.

Partnerships are fairly easy to set up. A benefit of entering into a partnership is the sharing factor. It means responsibilities, administration, and so on are shared and can be divided according to each person’s strengths and experience. The downside of that is you – and the business – could be susceptible to one of your partners making mistakes or conflict arising.

3. Limited company

In terms of business structure, ‘limited’ here means ‘limited by shares’ or ‘limited by guarantee’. What that means in both cases is that the company is legally separated from the people who own and/or run it. A limited company can also choose to enter into a partnership with another business.

A limited company is more demanding than the previous structures and requires a higher degree of paperwork and administration. Accounts need to be filed regularly and you are subject to corporation tax. You need a robust paper trail that covers every transaction and any other expenditure or income. If you fail to do so, HMRC (His Majesty’s Revenue and Customs) can impose financial penalties or disqualify people as company directors.

Limited companies are perceived as more professional than the previously mentioned structures. They are also less risky in many ways, as business debts and responsibilities are separate from your personal assets. They do come with major administrative burdens and lack privacy as all information and accounts are available to the public from Companies House.

4. Limited liability partnership (LLP)

An LLP can be set up with two or more people or entities (such as another business). The ‘limited liability’ part refers to the fact that your liability in the business only refers to the amount you have invested. Responsibilities – and entitlement to profits – can be divided up according to what share of the business you own.

Similarly to a limited company, Companies House holds all your information and it is available to the public. Your personal assets are again protected so if something goes badly wrong, only your investment would be liable. There are rules around any profits; they can’t be kept beyond the financial year in which the occur, and LLPs can also incur high administrative costs.

Why are partnerships important?

As you can see, it’s often not just a case of having capital and an idea; a strategic partnership can strengthen your business and enable you to utilise the different skills and qualities of each partner. There are some things any small business should be thinking about such as FP&A meaning as this can contribute towards your financial and operational planning.

You need to look at what a partnership will offer you; will it enhance efficiency? Spread awareness and reach? Each type of partnership can bring common and unique benefits – let’s find out more about these.

Value

Prospective partners may bring different types and levels of value to your business. Maybe they’re a leading influencer in your sector with a substantial following. Perhaps they’re a tech expert with in-depth knowledge of integrated ERP systems.

Or maybe they can help gain access to business events or chambers of commerce. Before you decide on and commit to any type of partnership, you have to know what the person (or entity) will add to your business’s value.

Authority

Why should potential customers trust an unknown name or brand? Partnering with an established business – or a well-known name – can add a layer of authority and credibility you may not otherwise have. That partner may also have strong connections within your sector that can help you with suppliers and/or manufacturers.

Scalability

You may start small but you have big dreams. Partnerships can often be the ladder to those dreams. For example, you may have developed a tool for screen sharing that is better than anything currently available. By partnering with an established tech or communications business, your business products are exposed to a larger audience and your business will grow.

Security

Cybersecurity is essential for any business with an online presence. An established business will likely have existing measures that they can apply to a new partner or help in implementing such measures.

How to approach partnerships as a small business owner

Starting a business is a big decision and comes with many responsibilities, such as market research or asking yourself questions such as: why is vendor risk management important? If you think that entering a partnership is going to be beneficial to your business, there are several best practices you should consider following.

1. Build a partner persona

A buyer persona can help you identify your ideal customer(s) and can inform strategies like email marketing and product development. Similarly, a partner persona can help you pinpoint the type of partner you want and who can enhance your efficiency, give you greater reach, or help you with any marketing tactics. What should you look for in a partner?

- Research your sector and identify the ideal company working in your field. List the attributes and brand positioning of that company you see as attractive as the framework of your partner persona.

- Define your partnership goals. What is it that you feel you need help with? Is your prospective partner an industry leader and will they provide marketing expertise, authority and credibility, or access to new markets and customers? What will they contribute to in terms of business development?

- Identify what you offer. Does your potential partner have pain points you can solve? Maybe you’ve developed a tool that will integrate with their platform that fulfills a need. You need something that makes you attractive as a partner.

- Think about a framework. How will the partnership be structured? If you’re a one-person operation and the potential partner is an established business, there has to be benefits to them as well as you.

2. Set a timeframe

Be realistic, a partnership will not achieve success overnight. You have to set clear partnership goals and the timeframe for those goals. You also need to think about how you will measure progress and what metrics you will primarily use.

Unless you have done a lot of pre-launch work, you may not have a partner until the end of Q1 or even the beginning of Q2, for example. This means you need to set some parameters on the timeframe for making the partnership work.

3. Define partnership roles

One of the crucial aspects of any partnership is what roles each partner will fill. The partnership itself can be based on several factors, but what roles will drive the partnership forward? You need to decide which partner will take responsibility for things such as marketing, selling, social media engagement, and even internal audit (read this for a comprehensive definition of internal audit meaning).

The thing to note here is that, if your prospective partners are a well-established business, then they may have teams with experience in digital marketing, or they may have a website that receives a lot of daily visitors. However, that does not automatically mean they will fill those roles, but they may be prepared to share business resources or even offer training and help in those areas.

4. Find the perfect fit

It may be tempting to make a partnership decision sooner rather than later. It’s best to avoid that temptation and find a partner that is a perfect fit for you and your needs. It’s also worth emphasising that your ideal partner doesn’t need to be another business; they may be an individual looking to invest or who has significant experience and knowledge of your sector.

Look for a partner who shares your vision and values and who believes in what you are doing. They may have ideas that increase productivity or improve efficiency, or they may even simply open doors for you. But those doors could lead to increased revenue and profitability.

And remember, data security is always of the utmost importance, so finding a partner you know you can trust is invaluable. Depending on where you’re based, you might also want to find out whether your partner has any specialised knowledge – for example, if you’re in the US, you’ll want a partner who fully understands the SOX compliance meaning.

The takeaway

Even an experienced entrepreneur will look to strategic partnerships as a way to make their business more efficient and profitable. That might be anything from relevant government agencies to angel investors to a partner who can bring something beneficial to the business.

In some cases, a partnership may be based on financial needs, especially if you don’t want to take out a bank loan. In other cases, you may have a great online business idea and the necessary funds, but lack the experience and human resources to make it a success. Whatever your circumstances, a well-thought-out strategic partnership could be the thing that enhances your efficiency and makes your business a success.