KSA Group Limited, insolvency practitioners and authors of the UK’s largest insolvency website at Company Rescue has published research into whether there is a gender bias on the board of companies that become insolvent. KSA looked at the insolvency rate of companies where their board make up was 75% or more male or 75% or more female in the 12-month period of October 2021-22. For comparison it also looked at companies where there was only one director.

The statistics show that businesses with 2 or more directors that are women have a lower rate of insolvency with a rate of 0.59% for women-dominated boards versus 0.84% for male-dominated boards. So, companies were 42% more likely to become insolvent if their board is made up of 75% men or more. Last time KSA Group researched this in 2018 it was nearer 70% more likely. For single male director companies, the insolvency rate was still 30% higher than female at 1.08% compared to 0.77%

What has been shown though, perhaps not surprisingly, is that the overall insolvency rate for all businesses has increased when compared to 2018. For male dominated businesses the rate has increased from 0.34% of all businesses to 0.84% and for women run businesses it has increased from 0.20% to 0.59%. This broadly reflects the pattern of increased numbers of insolvencies following the pandemic.

Key findings in 2021/22

• Insolvency rate is up to 40% higher in male run companies

• 4 times as many companies are run by majority men than women

• Overall insolvency rate in both groups has increased by a factor of 200%

What conclusions can we draw from these findings?

Robert Moore at KSA Group said; “It is apparent that the insolvency rate is higher in male run businesses, but this may be due to a number of factors that have nothing to do with whether men are less effective at running businesses than women. It may well be that the businesses that tend to be more likely to become insolvent due to the nature of the industry or recent economic events are coincidently run by men.”

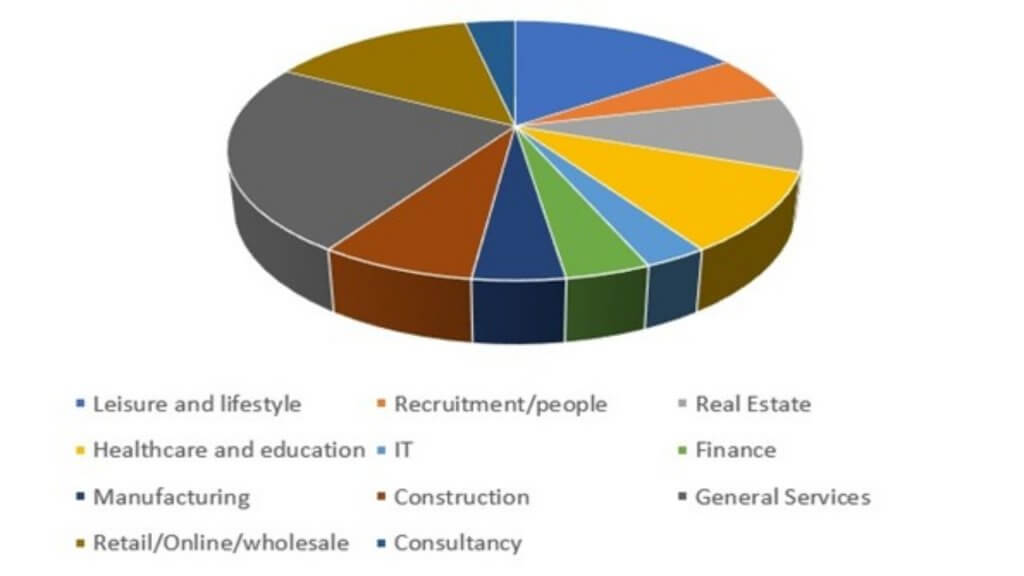

• The study found that property letting businesses and hospitality were overly represented in the data set of female-dominated businesses that have become insolvent. For male-dominated businesses construction was the most represented industry with 16% of those companies going insolvent but for women it was 5%

We do not have the data on the overall percentage of each industry across all active companies so it is difficult to draw conclusions on whether this is a sector specific problem. It should be noted that the gap between the performance of men and women run businesses has narrowed since 2018. The pandemic has perhaps hit a much wider range of businesses and made profitable and stable companies suddenly unviable. So, women who may take less risks in business, than perhaps men, in a normally functioning economy suffer disproportionally more when there is a massive external shock?

See the pie charts below which show the industry distribution represented by insolvent companies depending on gender bias.

Pie charts

Male Dominated Insolvent Companies

Female dominated insolvent companies

About the Study

For the analysis KSA Group researched Creditsafe’s database of 4m companies in the UK.

In order to do the analysis, 2 lots of 4 data sets were collected:

• A count of all active companies with just 2 men on the board or a majority of 75% of the board that have been actively trading in the last 12 months ? 579832

• A count of boards containing just 2 women or a majority of 75% of the board that have been actively trading in the last 12 months ? 67047

• A count of all companies that went into administration or liquidation in male-run businesses as above ? 4870 companies went into liquidation, compulsory liquidation ( winding up order) administration or appointment of liquidators from October 2021

• A count of all companies that went into administrator or liquidation in female-run businesses as above ? 397 companies went into liquidation, compulsory liquidation ( winding up order) administration or appointment of liquidators from October 2021

Businesses with less than a 75% gender bias were excluded.

• A count of all active companies with just 1 man on the board that have been actively trading in the last 12 months ? 1776275

• A count of companies containing just 1 women on the board that have been actively trading in the last 12 months ? 539861

• A count of all companies that went into administration or liquidation in male-run businesses as above ? 19262 companies went into liquidation, compulsory liquidation ( winding up order) administration or appointment of liquidators from October 2021

• A count of all companies that went into administrator or liquidation in female-run businesses as above ? 4196 companies went into liquidation, compulsory liquidation ( winding up order) administration or appointment of liquidators from October 2021

The question of whether male or females are better at running businesses has been researched in America https://journals.aom.org/doi/abs/10.5465/256305. The researchers found that there was no discernible difference. However, research done after the financial crisis did show that female-run banks were less likely to go bust https://link.springer.com/article/10.1007/s10551-014-2288-3.

Clearly more studies could be done in this area to see if there really are any gender influences in business failures. Given that many business failures are caused by not acting early enough and not taking advice then the old cliché that men don’t follow instructions or ask for help in many aspects of their lives may just be true in their roles as Directors of companies. Another possible explanation is that Men are more prone to risk taking and that will inevitably lead to higher insolvencies.